Content

It’s crucial to be aware of possible fees, even though some platforms offer commission-free trading. Remember that not all brokerages provide the same access to all asset classes. An online broker is a digital platform that allows you to buy and sell securities, such as stocks, bonds, mutual funds and ETFs. Charles Schwab also boasts no commissions on stocks, ETFs and options and no difference between brokerage fee and commission account minimums.

Summary of the best online brokers:

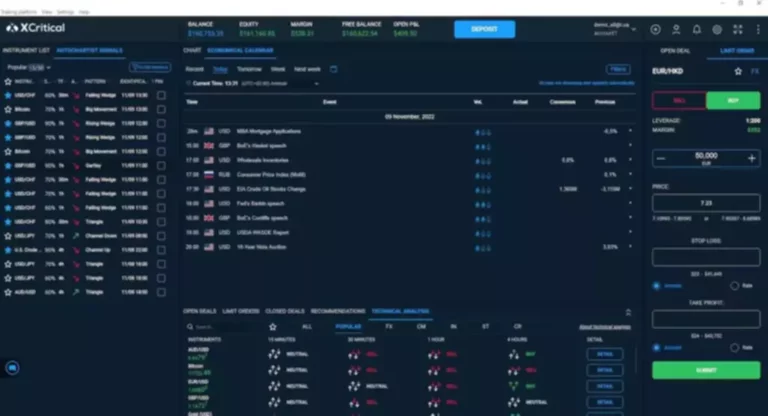

Once you’re ready to dive https://www.xcritical.com/ in, one-click trading makes investing almost too easy. Picking the best online brokerage platform isn’t always intuitive. Research is especially important with so many competitors in the field. Savings accounts or checking accounts just do not have those features.

eToro: Best for Social Cryptocurrency Trading

Of course, commissions on stocks and ETF are at the industry-standard of $0, but options cost $1 for a round-trip contract – so no incremental fee to close out a position – and they’re capped at $10 per leg per order. The top brokerage accounts charge the lowest fees with little to no commissions. However, advanced brokerages with more sophisticated trading tools and investment options tend to charge more for their services. Yes, some brokerage firms offer commission-free trading for certain types of assets or accounts, particularly in the case of stocks, ETFs, or mutual funds. Commission-free trading has become increasingly common as brokerage firms compete to attract clients and differentiate their services in the market.

Chart to compare discount online brokerage companies accounts on pricing, investment products, trading tools, beginner

Options trading fees are in this category, as most brokers charge a small fee (usually in the $0.50 to $1.00 range) for every contract traded. Visit vanguard.com to obtain a prospectus or, if available, a summary prospectus, for Vanguard and non-Vanguard funds offered through Vanguard Brokerage Services. The prospectus contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

How quickly can I start trading with an online broker?

The star ratings below represent each online brokerage’s overall score. That way, we’re able to report on every aspect of the user experience, from funding a new brokerage account to actually placing trades. These fees vary by broker but can range from $10 to as much as $75. (Consult our picks for best mutual fund providers for cost-conscious investors.) Fortunately, transaction fees are easily avoided by selecting a broker that offers a list of no-transaction-fee mutual funds — most do.

Common investments like stocks and ETFs are available to you, but so are bonds, options, OTC stocks, and cryptocurrencies. Public is the red pill to brokers like Robinhood, which make money off of payment for order flow (PFOF). Instead of using PFOF, Public charges customers up front, doing away with any uncertainty about price execution. Other nifty perks like mutual funds trading and IPO access make SoFi worth a look. Check it out if you want to do all your money management in one place, at great prices. You can buy stocks online without a broker using the Direct Registration System.

- Before saving in a taxable brokerage account, it’s important to consider where saving adds the most value to your unique financial situation.

- For detailed information about the categories considered when rating brokers, read our full methodology.

- Look for a broker that offers premium research and data for free.

- That means it protects a customer’s assets, up to $500,000 in total with a $250,000 limit on cash, in the event that the broker fails.

- There are many, and the best part is they tend to outperform load funds over time, which means there’s no extra value in choosing a more expensive fund.

- ” One key difference is that online brokers cater to do-it-yourself (DIY) investors.

- Fortunately, analysts see positive earnings and revenue growth for every market sector this year.

The company has among the most diverse offerings of any brokerage, with something for every type of investor. Access the broker through its website, mobile app or proprietary trading platform. Fidelity is also a good choice if you want to keep costs low. The firm offers no commissions on stock, ETF, options and many mutual funds. Retirement-focused investors or those with more complex finanical situations may want access to a CFP or human consultant. While many online brokerage platforms offer this service, who is eligible and how much it costs greatly varies from platform to platform.

If you have more money than time, a full-service broker (or a financial advisor) may be for you. For most investors, however, it can pay to simply open a brokerage account at an online broker such as the ones we’ve listed here. These brokers allow you to buy stocks yourself through their websites or trading platforms, often with no fee or commission. Last, fees can also vary based on the trading platform used by investors. Advanced trading platforms with sophisticated features, advanced charting tools, and real-time market data may come with higher fees or subscription costs.

There are a lot of factors to consider when selecting a broker, and the decision will likely come down to individual priorities. Some investors are willing to pay higher fees for a state-of-the-art platform; others count costs above all else. Some may want to stick with the largest brokerage firms with heavy name recognition; others may be more interested in sifting through the smaller brokers to find the perfect fit for them. Many funds on this list will be from the broker itself, but other mutual fund companies often pay brokers to offer their funds to customers without a transaction cost.

While online brokers harp on their low costs–not just for trades but also low minimums to open accounts and low costs for access to research, tools, and services–full-service brokers boast of the wide range of their offerings. Those include everything from personal financial planning to insurance, estate planning, retirement planning, accounting services, tax advice, and more. Through our exhaustive research, we found that Fidelity not only outshines the competition when it comes to ETF investing, low costs, and cash management features, but it is also the best online brokerage platform overall. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every stock-trading platform review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of investing products. See our methodology for more information on how we choose the best free stock-trading platforms.

The best broker for you will ultimately depend on your individual goals, priorities, and preferences. Some investors may require advanced platforms with access to niche markets and exotic instruments, while others happily settle for a simple, user-friendly mobile app and cost-effective pricing. Whatever your objectives, here are some key factors to consider when choosing an online broker. This idea of simplicity is really where things have been getting interesting for Interactive Brokers, as the company has committed to making its platforms more accessible to beginners. We reviewed each company’s customer support structure, available avenues of communication and app reviews.

There’s much to consider when choosing the best online broker. You want a brokerage that can satisfy your needs today and in the future. It also provides a library of resources to help you elevate your trading expertise. There’s something for every level of trader here, from new to experienced. Read and compare online broker reviews, rankings, and features. Trading is exchanging [which is] usually short-term in nature.

Taxable accounts can be a good vehicle if you can check all the boxes. Most often, the account you have set up in a brokerage will be a flexible investment. This is great because you have use of the money for various purposes, and you are not tied to specific withdrawal requirements the same way you would be in a retirement or college 529 account. Other investable securities include over 4000 stocks and ETFs in five different kid account options and one adult account. Parents and kids will enjoy the built-in education resources, such as the “mini-lessons,” which teach stock market basics that prepare anyone for a more successful future in the stock market.

In addition to those features, the companies that made our list of the best brokers don’t charge commissions when trading stocks or exchange-traded funds. Other fees may creep up — most commonly, brokers tend to charge contract fees to trade more complex investments like options, and there may be fees to transfer investments out of your account. Interactive Brokers gives you access to stocks, ETFs, options, futures, forex, cryptocurrencies, and mutual funds in over 150 markets. That’s the widest range of tradable securities on this list by far, and the most comprehensive access to global markets among our best brokers.

You also won’t have access to the research tools, educational materials or real-time trading brokers offer. Further, orders may be processed less frequently, such as daily or weekly, rather than in real time. Fidelity offers Active Trader Pro, a trading platform that incorporates a number of its other tools and features. You can build stock charts, analyze the action with dozens of technical indicators, place multiple trades at one time and stream Bloomberg TV right to your desktop. You’ll also get real-time news, earnings reports and other economic news, so you stay on top of the market. Plus, you’ll have immediate access to tools such as Real-time Analytics, which offers trading signals when a stock crosses key technical levels, and Trade Armor, which visualizes your trading opportunities.