This variance would be posted as a credit to the variable overhead rate variance account. If the $2,000 balance is a credit balance, the variance is favorable. This means that the actual direct materials used were less than the standard quantity of materials called for by the good output.

Standard Costing Volume Variance

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. If the balances are considered insignificant in relation to the size of the business, then they can simply be transferred to the cost of goods sold account.

Labor Rate and Efficiency Variances

The difference between the debit and the credit goes to the direct materials quantity variance account. The reason for the difference is that direct materials price is determined when direct materials are purchased. The responsible parties are purchasing manager or the purchasing department in general.

- SQ and SP refer to the “standard” quantity and price that was anticipated.

- Throughout our explanation of standard costing we showed you how to calculate the variances.

- The volume variance can also be calculated by multiplying the difference in the hours by the standard fixed overhead rate.

2.4 Quick Note on Multi-product Firms’ Sales Volume Variance

Total production of 210,000 units × Standard cost of$4.50 per unit equals $945,000; the same amount you see in theentry presented previously. The credit goes to several differentaccounts depending on the nature of the expenditure. For example,if the expenditure is for indirect materials, the credit goes toaccounts payable. If the expenditure is for indirect labor, thecredit goes to wages payable.

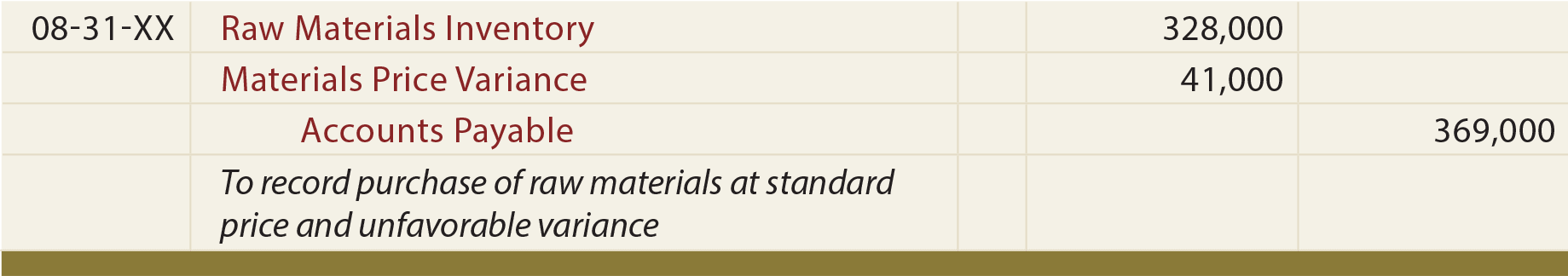

If actual cost exceeds standard cost, the resulting variances are unfavorable and vice versa. The overall labor variance could result from any combination of having paid laborers at rates equal to, above, or below standard rates, and using more or less direct labor hours than anticipated. To balance it, the firm debits or credits the difference to the direct materials price variance account.

1.6 Standards: Price and Quantity

To begin, recall that overhead has both variable and fixed components (unlike direct labor and direct material that are exclusively variable in nature). The variable components may consist of items like indirect material, indirect labor, and factory supplies. Fixed factory overhead might include rent, depreciation, insurance, maintenance, and so forth. Because variable and fixed costs behave in a completely different manner, it stands to reason that proper evaluation of variances between expected and actual overhead costs must take into account the intrinsic cost behavior. As a result, variance analysis for overhead is split between variances related to variable overhead and variances related to fixed overhead.

An unfavorable sales volume variance could reflect an unmotivated sales force, poor brand recognition, lack of consumer confidence, or competitive pressure. If variance is the difference between budgeted results and actual results, then I can restate the profit equation as follows. One of the purposes of cost accounting is to hold people and things responsible for the costs they cause.

Whatever the cause the business should decide what action it needs to take to correct the situation. In a standard costing system, allinventory accounts reflect standard cost information. Thedifference between standard and actual data are recorded in thevariance accounts and the manufacturing overhead account, which areultimately closed out to cost of goods sold at the end of theperiod.

Notice that the standard cost of $686,800 corresponds to the amounts assigned to work in process inventory via the various journal entries, while the total variances of $32,200 were charged/credited to specific variance accounts. By so doing, the full $719,000 actually spent is fully accounted for in the records of Blue Rail. The exception is when transactions are initially recorded at their standard costs in the accounting records. This only happens when inventory is recorded at its standard cost, rather than its actual cost.

If DenimWorks produces 100 large aprons and 60 small aprons during January, the production and the finished goods inventory will begin with the cost of the direct materials that should have been used to make those aprons. It is assumed that the additional 8 hours profit center: characteristics vs a cost center with examples caused the company to use additional electricity and supplies. Measured at the originally estimated rate of $2 per direct labor hour, this amounts to $16 (8 hours x $2). As a result, this is an unfavorable variable manufacturing overhead efficiency variance.